Join Us: Fight Hate for Good

With your support, ADL fights antisemitism, combats extremism, disrupts online hate and battles bigotry wherever and whenever it happens. Join us to fight hate for good.

How You Support Our Work

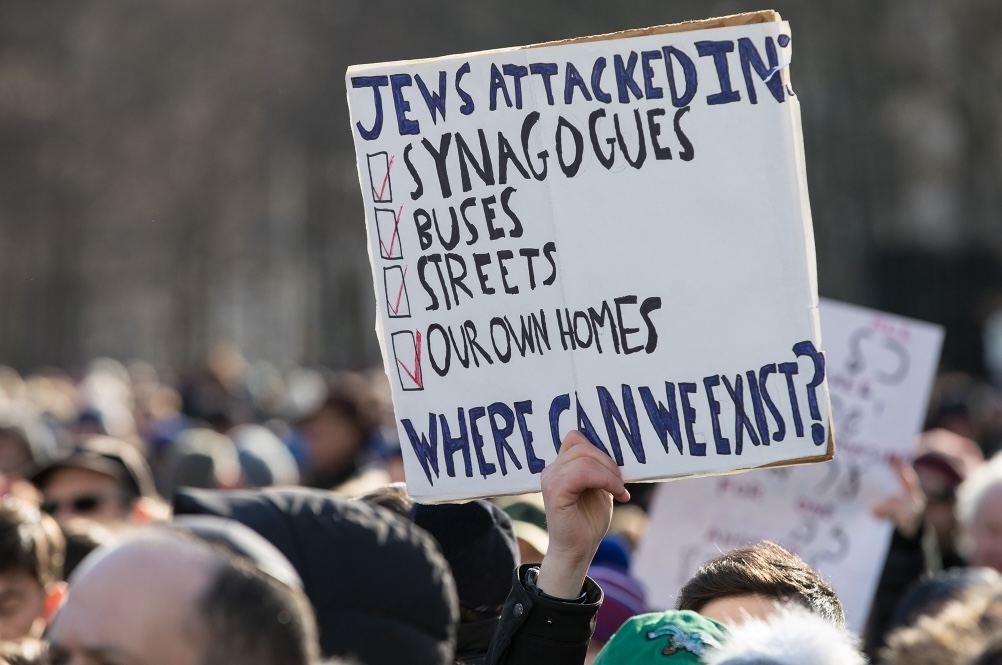

Fight Antisemitism

You empower individuals and communities with tools to address this age-old hate.

Combat Extremism

You enable ADL to monitor, expose and disrupt extremist threats from across the ideological spectrum.

Challenge Bias and Discrimination

You help communities across the country become safer, more inclusive and equitable places.

Disrupt Online Hate

You support ADL to combat hate and harassment online and push extremism back to the fringes of the digital world.

Your Very Own Planning Toolkit to Help You Get Started

Join ADL supporters on Giving Docs to start your will and plan your legacy. It’s safe, secure and free-for-life for our supporters.

Sample Language for Your Will or Trust

For Trustees and Advisors

Sample Beneficiary Designation

Gifts from Donor-Advised Funds

Complimentary Planning Resources